(Photo : commons.wikimedia.org)

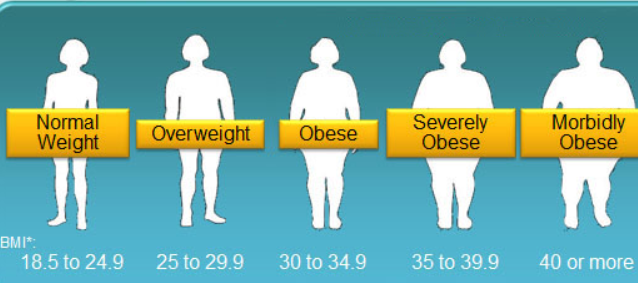

Obesity

- Eli Lilly's Zepbound is set to lead the global obesity market, surpassing Novo Nordisk's Wegovy due to its superior efficacy.

- Zepbound has shown more effectiveness in promoting weight loss and recently received US FDA approval for obstructive sleep apnea.

- Despite Wegovy's significant impact, Zepbound's potency and potential cost-effectiveness could make it a more appealing option.

- The global obesity market is highly competitive, with over 400 companies developing drugs, but Zepbound's strategic market expansion positions it well for dominance.

In a significant development in the global obesity market, Eli Lilly's Zepbound drug is poised to take the lead, according to a report by GlobalData, a leading data and analytics company. The drug, which has been on the market for a year, is expected to surpass Novo Nordisk's Wegovy (semaglutide) due to its superior efficacy and strategic market expansion. Zepbound (tirzepatide) emerged as the primary new competitor of Wegovy from the start, with Eli Lilly seemingly following Novo Nordisk's strategy to increase the patient population by investigating the drug in multiple indications. This was stated by Costanza Alciati, a pharma analyst at GlobalData.

Eli Lilly recently announced the results from its SURMOUNT-5 trial, which compared the efficacy of Zepbound and Wegovy. Zepbound was found to be more effective in promoting weight loss. While Wegovy caused an average weight loss of 13.7 per cent body weight, Zepbound promoted around 20.2 per cent body weight loss in patients. On December 20, 2024, tirzepatide also received US FDA approval for obstructive sleep apnea. The drug is being investigated for four additional indications, including cardiovascular risk factors, chronic kidney disease, and metabolic dysfunction-associated steatohepatitis (MASH).

Zepbound vs Wegovy: A New Chapter in Obesity Treatment

The obesity market has seen a significant impact from Wegovy, with Key Opinion Leaders (KOLs) interviewed by GlobalData defining it as "revolutionary". However, with Zepbound, the revolution continues. Eli Lilly's drug is more potent, and perhaps negotiations with national health services will also make it more cost-effective than Wegovy, said Alciati.

In the wake of these developments, Novo Nordisk revealed disappointing results in a late-stage trial for its experimental next-generation obesity drug CagriSema, causing a significant drop in its market value. The results were a "worst-case scenario" for Novo, according to Markus Manns, a portfolio manager at Union Investment, a Novo and Lilly shareholder.

FDA Approval and the Future of Obesity Drugs

Meanwhile, the FDA has approved Zepbound for obstructive sleep apnea, a condition affecting as many as 30 million people in the US and closely associated with obesity. The approval is based on two company-sponsored trials encompassing about 470 participants.

In the broader context, the global obesity market is witnessing a surge in the number of companies actively developing obesity drugs. According to GlobalData's drugs database, more than 400 companies are in various stages of drug development, from discovery to pre-registration candidates. The obesity drug market is also seeing a flurry of innovation, with several new drugs promising weight loss and health benefits in the pipeline. However, the challenge for investors is that both Eli Lilly and Novo Nordisk currently trade in overvalued territory, according to Morningstar analysts.

* This is a contributed article and this content does not necessarily represent the views of btin.co.in