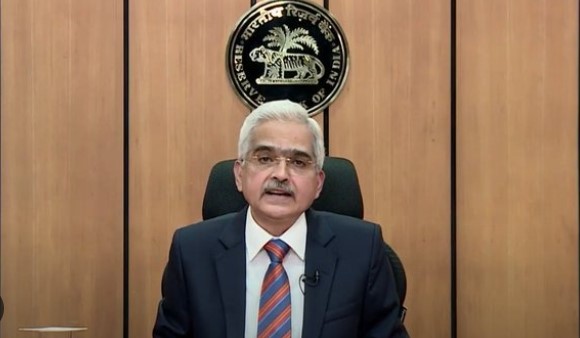

(Photo : PIB)

India may extend RBI governor Shaktikanta Das's term for a second time, making him the longest-serving chief since the 1960s.

The Reserve Bank of India (RBI) has decided to cut banks' cash reserve ratio by 50 basis points to 4%.

After a meeting of the central bank's Monetary Policy Committee's meeting on Friday morning, RBI Governor Shaktikanta Das said the move will ease the liquidity ratio for the banks.

The cash reserve ratio, or CRR, is the proportion of deposits that banks need to set aside as cash.The cut will be in two tranches of 25 basis points each, kicking in on Dec. 14 and Dec 28.

The reduction in CRR would free up 1.16 trillion rupees in the banking system, Das said.Advertisement · Scroll to continueEarlier, the central bank maintained its key interest rate.

Despite the RBI maintaining the status quo on key interest rates, Indian equity benchmarks returned to positive territory. The benchmark 30-share BSE Sensex climbed up to 0.10 per cent in late-morning deals 84.81 points, reaching 81,850.67 at 11 am, while the broader NSE Nifty was up 0.07% or by 17.05 points reaching 24,725.45.

This upswing occurred even as the RBI kept key interest rates unchanged due to high inflation. The central bank has maintained the key policy repo rate at 6.5 per cent for the 11th consecutive time since February 2023.

Deven Choksey, Managing Director of DRChoksey FinServ, commented on the CRR cut, stating, "This will be positive for most banks and their MTM profits on treasury bonds portfolio. This is the beginning of the fall in the interest rates cycle."

Impact on GDP and Inflation

Meanwhile, India's GDP growth slowed to 5.4% in the July-September quarter, marking its weakest pace in seven quarters. Retail inflation climbed to 6.21% in October, surpassing the central bank's tolerance band for the first time in over a year.

The central bank had projected a 7.2% GDP growth for FY25, but this is likely to be revised following the latest September 2024 quarter numbers that showed India's GDP growth slowing to a seven-quarter low of 5.4%. But the RBI has raised interest rate ceilings on FCNR-B deposits and increased FCNR deposit rates to make India a more attractive destination for foreign investments.

The RBI has also announced an increase in the collateral limit for agricultural loans, raising it from Rs 1.6 lakh crore to Rs 2 lakh crore per borrower. This move is designed to offer enhanced financial support and stability to farmers, while also enabling greater credit availability in the agricultural sector.

Repo Rate Unchanged

In the face of inflation and growth concerns, the central bank has kept the repo rate unchanged at 6.5%. The RBI's current monetary policy stance is 'withdrawal of accommodation', signalling that monetary policy will likely remain tight. Governor Das acknowledges that the divergence between deposit growth and credit expansion could lead to liquidity management issues that banks need to address.

He clarified that while he is not directing individuals to choose deposits over market investments, he stressed that the decision on where to invest remains up to the individual. Governor Das also noted that India is now significantly more resilient compared to earlier periods. He said it is premature to declare a recession and stressed that while India has enhanced its resilience to external shocks, it is crucial to wait for more data before drawing conclusions.

Das also mentioned that the current account deficit is expected to be modest and comfortably financed nine foreign exchange reserves at US dollar 640 billion provide a strong buffer against global spillovers.