(Photo : Wikipedia./BT Creative)

China immediately bans export of dual-use items related to gallium, germanium, antimony, and superhard materials to the United States.

- China has banned the export of certain "dual-use items" to the U.S., escalating trade tensions.

- This move is a response to the U.S.'s crackdown on China's semiconductor industry.

- The escalating trade tensions could disrupt the global supply chain and impact global economic growth.

- The situation underscores the need for a negotiated solution to the trade tensions.

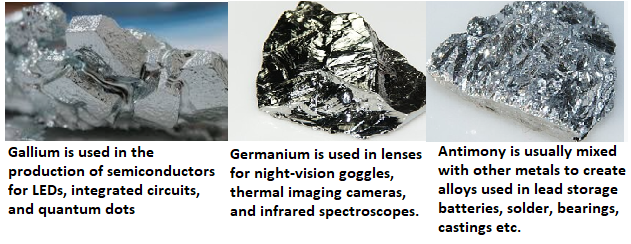

In a significant move that has sent shockwaves through the global economy, China has announced an immediate ban on the export of dual-use items related to gallium, germanium, antimony, and superhard materials to the United States. This decision, announced by China's commerce ministry, comes in the wake of Washington's latest crackdown on China's semiconductor industry. The ministry's directive, citing the safeguarding of national security and interests, also calls for a stricter review of end-usage for graphite dual-use items shipped to the United States.

This move is seen as a strengthening of existing limits on exports of these critical minerals that Beijing began to roll out last year. However, these restrictions specifically target the United States, marking the latest escalation in trade tensions between the world's two largest economies. This comes at a time when President-elect Donald Trump is preparing to take office.

The United States, on Monday, launched its third crackdown in three years on China's semiconductor industry, curbing exports to 140 companies, including chip equipment maker Naura Technology Group. In response, China's commerce ministry stated, In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted.

China's Response to U.S. Crackdown

This latest move by China signals a ramping up of trade tensions between the two economic giants. The measures are perceived as a direct response to U.S. policy shifts as the nation prepares for a new presidential administration. The ban comes hot on the heels of a fresh U.S. crackdown on China's semiconductor sector, which affects 140 companies, including key player Naura Technology Group. The directive from China's commerce ministry also mandates tighter controls on graphite dual-use items heading to the U.S.

The escalating trade tensions between the U.S. and China have historical precedents. During the Cold War, the U.S. imposed export controls on the Soviet Union to limit its access to advanced technology. However, the current situation is more complex due to the interconnectedness of the global economy and the critical role of China in global supply chains.

Implications for the Global Economy

The U.S. has been increasingly concerned about China's growing technological capabilities, particularly in the semiconductor industry. Semiconductors are vital components in a wide range of products, from computers and smartphones to military systems. The U.S. has been implementing measures to restrict China's access to advanced semiconductor technology, citing national security concerns.

In response, China has been investing heavily in its semiconductor industry to reduce its dependence on foreign technology. However, the U.S. restrictions have hindered China's progress in this area. The latest U.S. crackdown on China's semiconductor industry is seen as a significant blow to China's ambitions to become a global leader in this critical technology.

The escalating trade tensions between the U.S. and China have significant implications for the global economy. The semiconductor industry is a critical part of the global supply chain, and disruptions in this industry could have far-reaching effects. The escalating trade tensions could also lead to a further decoupling of the U.S. and Chinese economies, which could have significant implications for global economic growth and stability.

* This is a contributed article and this content does not necessarily represent the views of btin.co.in