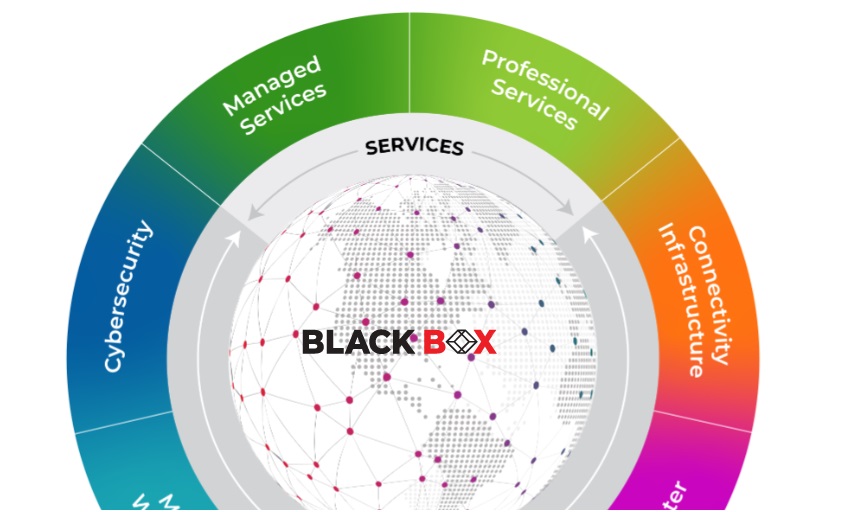

(Photo : Black Box)

Black Box

- Black Box Ltd reported a significant increase in its EBITDA and PAT for Q2 and H1 of FY25.

- Despite robust growth, delayed project execution impacted revenue, but the company remains optimistic with an order book at $455 million.

- The company is focusing on reorganizing the business into industry verticals and a horizontal business layer, with secured funding of Rs 386 crore for investments in key focus areas.

- The integration of AI technologies and advanced analytics is transforming the industry, providing a competitive advantage, and driving growth, but also presents substantial risks.

Black Box Ltd, a leading IT solutions provider, has reported a significant increase in its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and PAT (Profit After Tax) for the second quarter and first half of the fiscal year 2025.

The company's EBITDA for the quarter rose to Rs 135 crore, marking a growth of 34 per cent YoY (Year on Year) and 18 per cent QoQ (Quarter on Quarter). For the first half of FY25, the EBITDA grew by 31 per cent YoY, reaching Rs 250 crore.

The company's PAT for Q2 FY25 stood at Rs 51 crore, a growth of 60 per cent YoY and 38 per cent QoQ. For H1 FY25, PAT increased to Rs 88 crore, reflecting a growth of 58 per cent YoY.

The company's revenue for Q2 stood at Rs 1,497 crore, compared to Rs 1,574 crore in Q2 FY24. For H1 FY25, revenue stood at Rs 2,921 crore compared to Rs 3,146 crore in H1 FY24.

Despite the robust growth, the company acknowledged that delayed project execution impacted revenue. However, the company remains optimistic about its future growth, with an order book at $455 million as of September 2024.

Strategic Initiatives and Future Growth

The company has undertaken strategic initiatives to drive revenue growth and create an organization ready for the future, driven by technological advancements. Sanjeev Verma, Whole Time Director, Black Box, stated that the company's strategic focus on reorganizing the business into industry verticals and a horizontal business layer will help transition into the next phase of growth.

The company has secured funding of Rs 386 crore, which will strengthen its balance sheet and help make accelerated investments to propel growth across key focus areas.

Deepak Kumar Bansal, Executive Director and Global Chief Financial Officer of Black Box, emphasized the company's commitment towards better performance achieved through operating leveraging. He stated that as the company re-architects its GTM (Go-To-Market), it will see further improvement in operating performance, higher profitability, and improved cash flows.

The Role of AI and Advanced Analytics

In the broader context, the integration of AI (Artificial Intelligence) technologies into existing business systems and processes is becoming increasingly important. AI tools such as machine learning, natural language processing, robotics, and computer vision systems are transforming operations and providing a competitive advantage.

However, the risks associated with integrating AI technologies are substantial, and developing the metrics to ensure AI success has been challenging.

In the retail domain, the leverage of advanced analytics is gaining extensive traction. The retail industry stands at approx. US$25 trillion in 2018 and is expected to rise up to approx. US$28 trillion by 2020. The leverage of analytics to enable businesses to make informed and intelligent choices has become a non-negotiable.