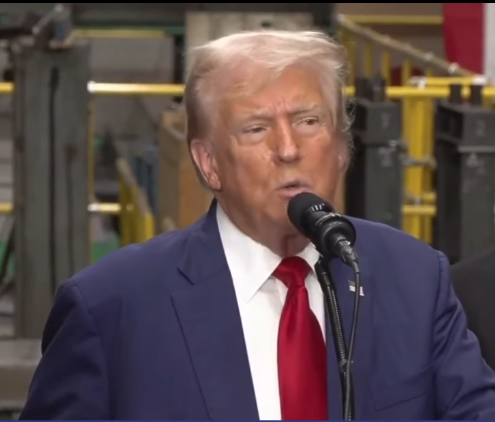

(Photo : Instagram)

- Donald Trump has won the 2024 U.S. Presidential election, marking his second victory against a female rival.

- The Republicans have gained control of the Senate, with the Democrats hoping to keep the House blue.

- The Federal Reserve is expected to cut its benchmark interest rate in response to the current labor market conditions.

- Trump's victory has sparked a surge in the stock market and has been met with mixed reactions internationally.

Donald Trump has secured his re-election as the President of the United States in the 2024 elections. This victory is significant as it marks the second time he has defeated a female rival in a general election.

Trump's victory has been attributed to his appeals to frustrated voters and his promises of economic prosperity. His win has also sparked a surge in the cryptocurrency market, with Bitcoin reaching a record high.

The election results have been met with mixed reactions. While Trump supporters celebrated the victory, Harris supporters were left in tears as the results rolled in. Despite the disappointment, Harris urged her supporters not to despair and instead encouraged them to mobilize and organize.

In her concession speech, she emphasized the importance of continuing the fight for freedom, opportunity, fairness, and the dignity of all people.

The election also saw the Republicans gaining control of the Senate, with the Democrats now looking to the final house races in hopes of keeping the House blue. The GOP currently holds 52 seats, with the Democrats at 44 members. The results of the remaining races in Pennsylvania and Nevada are expected to be announced soon.

Labor Market Conditions and Federal Reserve Response

The labor market conditions in the U.S. have also been a significant talking point during the election period. The number of Americans filing new applications for unemployment benefits rose marginally last week, suggesting no significant change in labor market conditions.

The employment growth slowed sharply last month, with nonfarm payrolls increasing by only 12,000 jobs, the fewest since December 2020. This slowdown was attributed to the disruptions caused by Hurricane Helene and Hurricane Milton, as well as a strike by factory workers at Boeing.

In response to the labor market conditions, the Federal Reserve is expected to cut its benchmark interest rate again, this time by a quarter of a percentage point to the 4.50%-4.75% range.

This move follows an unusually large half-percentage-point rate cut in September, the first reduction in borrowing costs since 2020. The Fed's decision to cut rates is seen as a measure to curb high inflation, which has been a concern for economists.

Stock Market Surge and International Reactions

Trump's victory has also had a significant impact on the stock market. U.S. stocks rallied sharply to notch record closing highs after the election results were announced. This surge was driven by investor expectations that Trump would lower corporate taxes and loosen regulations.

The Dow, S&P 500, and small-cap Russell 2000 all saw their biggest one-day rise since November 2022, while the Nasdaq hit its best day since February.

In the international arena, Trump's victory has been met with mixed reactions. South African President Cyril Ramaphosa expressed his hope for a continued close and mutually beneficial partnership between the U.S. and South Africa.

On the other hand, concerns have been raised about the potential shocks to democracy that Trump's return to power could bring, given his praise for strongman leaders and threats to deploy the military against political opponents.

As the U.S. moves forward under Trump's leadership, it remains to be seen how these developments will shape the country's future.