(Photo : Smart-Energy.com)

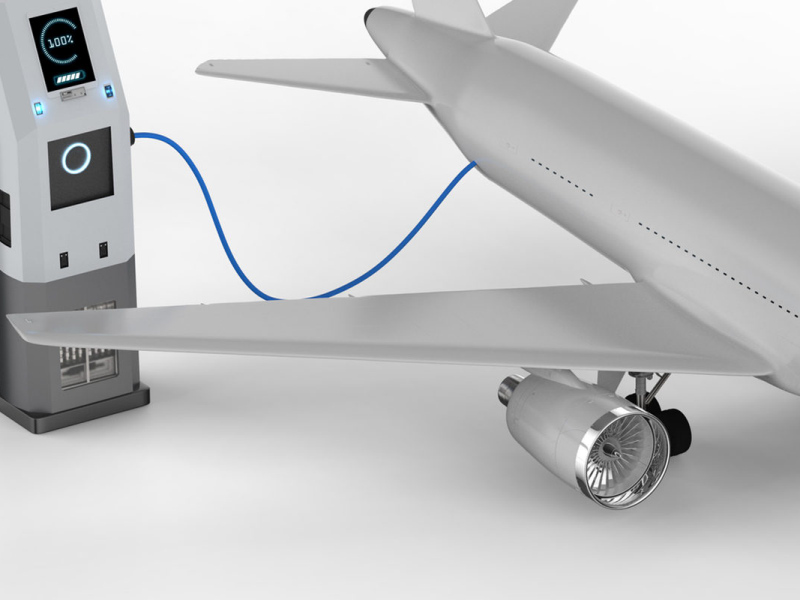

Electric aviation

- Mining giant Rio Tinto is in talks to acquire lithium producer Arcadium Lithium, a move that could make it one of the world's largest lithium producers.

- The potential acquisition comes amid a slump in lithium prices and a more than 50% drop in Arcadium's shares since January.

- The deal could value Arcadium between $4 billion to $6 billion, but both companies emphasized that there is no certainty that any transaction will proceed.

- The acquisition would give Rio Tinto access to lithium mines and deposits in several countries and could account for approximately 10% of the global lithium chemicals supply by 2030.

In a significant development that could reshape the global lithium market, mining giant Rio Tinto has confirmed it is in talks to acquire lithium producer Arcadium Lithium. The deal, if finalized, would catapult Rio Tinto to become one of the world's largest lithium producers, trailing only behind Albemarle and SQM.

This acquisition is a strategic move by Rio Tinto to secure a steady supply of lithium, a critical component in the production of electric vehicle (EV) batteries and power storage systems.

The potential acquisition comes at a time when lithium prices have slumped due to an oversupply in the Chinese market. This has led to a more than 50% drop in Arcadium's shares since January, making it an attractive target for Rio Tinto. However, lithium demand is expected to surge later this decade due to the growth in lithium-ion batteries.

The deal could value Arcadium between $4 billion to $6 billion or higher, as reported by Reuters. Both companies confirmed the approach in separate statements but did not disclose any financial details. They also emphasized that the approach is non-binding and there is no certainty that any transaction will be agreed upon or will proceed.

Rio Tinto's Strategic Move Amid Market Dynamics

The news of the potential acquisition led to a rally in Arcadium's shares, which surged as much as 50% before closing at A$6.09, up 46%. This also sparked a jump in other Australian-listed lithium companies, with shares up 2% to 10%. However, Rio Tinto's shares fell by 2%.

By acquiring Arcadium, Rio Tinto would gain access to lithium mines, processing facilities, and deposits in Argentina, Australia, Canada, and the United States. This would fuel decades of growth for the company. Additionally, Rio Tinto would also inherit Arcadium's customer base, which includes major automakers like Tesla, BMW, and General Motors.

Analysts at Canaccord predict that the combined group could account for approximately 10% of the global lithium chemicals supply by 2030. Rio Tinto's own Rincon project in Argentina is set to start producing later this year, while its Jadar project in Serbia could take two years to secure permits.

Concerns and Expectations Surrounding the Acquisition

However, the potential acquisition has raised concerns among some stakeholders. Andy Forster, a portfolio manager with Argo Investments, which holds shares in both companies, expressed caution about high valuations for Arcadium. He noted that while Arcadium has many growth projects, it lacks the balance sheet to build them. He also pointed out that the long-term pricing for lithium is not what it used to be.

Despite these concerns, analysts at TD Cowen expect Arcadium's output to grow by 78% over the next three years, which would give it earnings of $1.3 billion in 2028. They believe that valuation conversations would need to start at $5+/share, implying a premium of at least 60% on Arcadium's close of $3.08 on Oct. 4.

However, Blackwattle Investment Partners, in a letter to Arcadium, argued that any offers in the reported range would significantly undervalue the lithium company. They believe that a sale price for Arcadium should be closer to $8 billion and that Arcadium should be willing to walk away from an opportunistic offer.