(Photo : BLS)

US Jobs

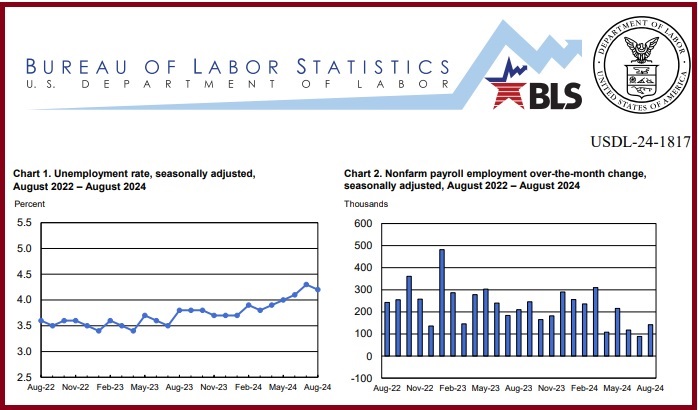

- The U.S. Labor Department reported slower job growth in August, with 142,000 jobs added, falling short of the 160,000 forecasted.

- Despite this, the unemployment rate dropped to 4.2%, and solid wage growth was reported.

- Industry-specific growth was led by the construction and healthcare sectors, while manufacturing and retail saw job losses.

- The Federal Reserve is expected to respond with a measured interest rate cut, and the labor market's future trajectory will be closely watched.

The U.S. Labor Department recently reported a slower than expected employment growth in August. Despite the addition of 142,000 jobs, the figures fell short of the 160,000 jobs economists had forecasted. However, the unemployment rate dropped to 4.2%, indicating that the labor market is not in a dire state that would necessitate a half-point interest rate cut from the Federal Reserve this month.

The report also highlighted solid wage growth in August, which is expected to support consumer spending and keep the economy from slipping into a recession. However, it was noted that labor market momentum has slowed, with 86,000 fewer jobs added in June and July than previously reported. This slowdown in employment growth is attributed to a decrease in hiring, while layoffs remain at historically low levels.

Jeffrey Roach, chief economist at LPL Financial, commented on this trend, stating, The labor market is cooling at a measured pace. The Fed will likely cut by 25 basis points and reserve the right to be more aggressive in the last two meetings of the year.

Sector-Specific Job Growth and Decline

In terms of industry-specific growth, the construction sector led the way, adding 34,000 jobs, primarily in heavy and civil engineering construction and nonresidential specialty trade contractors. The healthcare sector also saw a significant increase, adding 31,000 jobs. However, momentum in these sectors has slowed, with job gains about half the average monthly increase of 60,000 over the last 12 months.

On the other hand, manufacturing employment dropped by 24,000, and the retail sector shed 11,100 jobs. There were also job losses in the information industry. Temporary help employment, a potential indicator of future hiring trends, continued to shrink, albeit at a slower pace.

Despite the slower job growth, average hourly earnings rose 0.4% after gaining 0.2% in July. Wages increased 3.8% year-on-year after advancing 3.6% in July. This solid wage growth argues against the Fed delivering anything more than a quarter-point rate reduction, even though policymakers are now more focused on the labor market.

Federal Reserve's Response and Future Expectations

The report led to a chorus of Fed officials declaring that the U.S. central bank was ready to start cutting rates at its policy meeting in about two weeks. Higher borrowing costs are curbing overall demand in the economy.

In addition to the waning demand evident in declining job openings, the below-expectations rise in employment last month likely reflected a seasonal quirk, characterized by a tendency for August payrolls to initially print lower relative to the consensus estimate before being revised higher later.

The initial August payrolls counts have been revised higher in 10 of the last 13 years. Economists at Goldman Sachs noted that job growth decelerated by 42,000 relative to its 6-month average in industries that usually have a negative first-print bias in August, suggesting that today's print might understate actual job gains this month.

The Federal Reserve is now expected to respond with a measured interest rate cut, as solid wage growth should continue to support consumer spending and keep the economy afloat. However, the labor market's future trajectory will be closely watched in the coming months, as it will play a crucial role in shaping the Federal Reserve's monetary policy decisions.