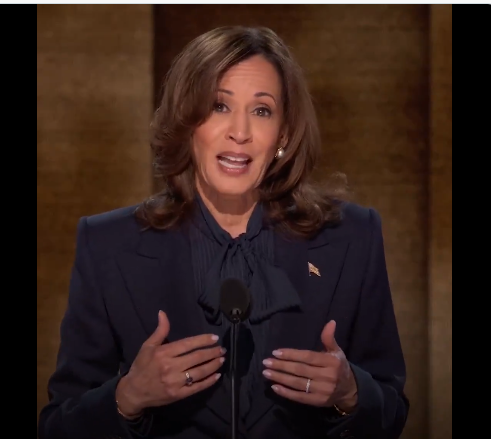

(Photo : https://x.com)

- Vice President Kamala Harris is proposing a $50,000 tax deduction for new small businesses.

- The plan includes a standardized tax deduction and a small business expansion fund.

- Critics argue the proposal could boost inflation and damage the economy.

- The proposal's impact on the economy and the presidential race will be closely watched.

Vice President Kamala Harris is set to propose a significant tax deduction of up to $50,000 for new small businesses. This proposal, which represents a tenfold increase over the existing relief, is part of Harris's broader economic strategy to win over middle-class Americans. The announcement is expected to be made in New Hampshire, a state that has been reliably blue in recent presidential elections.

Harris's economic agenda is progressive and focused on taxing wealthier individuals and corporations more, while increasing federal funding for child care and other social programs aimed at working parents. This approach is in stark contrast to her opponent, Republican Donald Trump, whose economic strategy has been centered on tariffs and taxes.

The proposed plan is expected to expand the startup expense deduction for small businesses from $5,000 to $50,000. This is a significant move considering that on average, it costs $40,000 to start a new business.

Harris's Plan: A Boost for Small Businesses

Small businesses form the backbone of the American economy, with the United States' 33 million small businesses employing about 46% of all private sector employees. These businesses have been responsible for 70% of net new jobs since 2019, according to the Small Business Administration.

In addition to the tax deduction, the plan will also propose a standardized tax deduction for small businesses, making it easier for them to navigate the complex tax landscape. It will also aim to simplify the process of obtaining occupational licenses across the country. Furthermore, the plan includes a small business expansion fund to enable community banks to cover interest costs.

However, Harris's economic agenda may face resistance from both corporations and Congress, which will need to pass laws to change most tax policies. Similar proposals from President Joe Biden have been rejected in the past. Despite potential hurdles, Harris remains committed to her economic strategy.

Criticism and Historical Precedence

Despite the positive outlook, the proposal has been met with criticism. Trump's economic advisers, Kevin Hassett and Stephen Moore, have argued that Harris's proposals would boost inflation and damage the economy. Republicans have also blamed Biden and Harris for presiding over an economy in which prices have risen and have accused their policies of driving inflation.

Harris's proposal is not without precedent. In the past, tax incentives have been used as a tool to stimulate economic growth and support small businesses. However, the scale of the proposed tax deduction is unprecedented and reflects the administration's commitment to supporting small businesses and spurring economic growth.

* This is a contributed article and this content does not necessarily represent the views of btin.co.in